| | | | | | TABLE OF CONTENTS

COOPER TIRE & RUBBER COMPANY COOPER TIRE & RUBBER COMPANYNOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO THE STOCKHOLDERS: The 20172020 Annual Meeting of Stockholders of Cooper Tire & Rubber Company (the “Company”) will be held at The Westin Detroit Metropolitan Airport, McNamara Terminal, 2501 Worldgateway Place, Detroit, Michigan 48242 on Friday, May 5, 2017,8, 2020, at 10:00 a.m., Eastern Daylight Time, for the following purposes: | (1)

| To elect eightnine Directors of the Company for the ensuing year. |

(2)

| To ratify the selection of the Company’s independent registered public accounting firm for the year ending December 31, 2017.2020. |

| (3)

| To approve, on a non-binding advisory basis, the Company’s named executive officer compensation. |

| (4) | To recommend, on a non-binding advisory basis, the frequency of advisory votes on the Company’s named executive officer compensation. |

| (5)

| To transact such other business as may properly come before the Annual Meeting or any postponement(s) or adjournment(s) thereof. |

As part of our precautions regarding the coronavirus (or COVID-19), the Annual Meeting will be a “virtual” meeting. The Company is making its proxy materials available electronically as the primary means of furnishing proxy materials to stockholders, who can participate in the meeting online at www.virtualshareholdermeeting.com/CTB2020 at the appointed date and time. This virtual approach to the Annual Meeting also provides a convenient way to access the Company’s proxy materials and vote, enables greater stockholder participation in the proceedings and reduces the cost and environmental impact of the Annual Meeting to the Company. Only holders of Common Stock of record at the close of business on March 10, 2017,13, 2020, are entitled to notice of and to vote at the Annual Meeting. To participate in this year’s virtual Annual Meeting, you will need the 16-digit stockholder control number located on the Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials, to log in to the Annual Meeting at www.virtualshareholdermeeting.com/CTB2020. Please keep your stockholder control number in a safe place so it is available to you for the meeting. Using this control number, you will be able to listen to the meeting live, submit questions and vote online. The Company encourages you to access the Annual Meeting before the start time of 10:00 a.m., Eastern Daylight Time on Friday, May 8, 2020. Please allow ample time for online check-in, which will begin at 9:45 a.m., Eastern Daylight Time, on Friday, May 8, 2020. BY ORDER OF THE BOARD OF DIRECTORS Stephen Zamansky, Senior Vice President, General Counsel and& Secretary Findlay, Ohio March 20, 201726, 2020 Please mark, date, and sign the enclosed proxy and return it promptly in the enclosed addressed envelope, which requires no postage. In the alternative, you may vote by Internet or telephone. See page 23 of the proxy statement for additional information on voting by Internet or telephone. If you are present and vote in person at the Annual Meeting, the enclosed proxy card will not be used.TABLE OF CONTENTS Table of Contents TABLE OF CONTENTS

(continued)

TABLE OF CONTENTS COOPER TIRE & RUBBER COMPANY 701 Lima Avenue, Findlay, Ohio 45840 March 20, 201726, 2020PROXY STATEMENT

GENERAL INFORMATION AND VOTING This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Cooper Tire & Rubber Company (the “Company,” “Cooper Tire,” “our,” “we,” or “us”) to be used at the Annual Meeting of Stockholders of the Company to be held on May 5, 2017,8, 2020, at 10:00 a.m., Eastern Daylight Time, at The Westin Detroit Metropolitan Airport, McNamara Terminal, 2501 Worldgateway Place, Detroit, Michigan 48242.Time. This proxy statement and the related form of proxy were first mailed or made available to stockholders on or about March 20, 2017.26, 2020. Purpose of Annual Meeting The purpose of the Annual Meeting is for stockholders to act on the matters outlined in the notice of Annual Meeting on the cover page of this proxy statement. These matters consist of (1) the election of eightnine Directors, (2) the ratification of the selection of the Company’s independent registered public accounting firm for the year ending December 31, 2017,2020, (3) the approval, on a non-binding advisory basis, of the Company’s named executive officer compensation, (4) the recommendation, on a non-binding advisory basis, of the frequency of advisory votes on the Company’s named executive officer compensation, and (5)(4) the transaction of such other business as may properly come before the Annual Meeting or any postponement(s) or adjournment(s) thereof. As part of our precautions regarding the coronavirus (or COVID-19), the Annual Meeting will be a “virtual” meeting, as permitted by Delaware law and our Bylaws. A virtual annual meeting format is expected to facilitate and increase stockholder attendance and participation by enabling stockholders to participate fully and equally from any location around the world. We remain sensitive to concerns regarding virtual meetings generally from investor advisory groups and other stockholder rights advocates who have voiced concerns that virtual meetings may diminish stockholder voice or reduce accountability. Our Bylaws provide that our annual meetings may be held by means of remote communication, subject to such guidelines and procedures as the Board may adopt from time to time. Accordingly, we have designed the procedures for our virtual meeting format to comply with these requirements and to enhance, rather than constrain, stockholder access, participation and communication. In preparation for the virtual Annual Meeting, (i) we will implement reasonable measures to verify that each person deemed present and permitted to vote at the Annual Meeting is a stockholder or proxy holder, (ii) we will implement reasonable measures to provide stockholders and proxy holders a reasonable opportunity to participate in the meeting and to vote on matters submitted to stockholders, if any, including an opportunity to read or hear the proceedings of the meeting substantially concurrently with such proceedings, and (iii) we will maintain a record of any votes or other action taken by stockholders or proxy holders at the meeting. Additionally, the online format allows stockholders to communicate with us during the meeting so they can ask appropriate questions of our Board or management in accordance with the rules of conduct for the meeting and as described under “General Information and Voting-Questions.” During the live Q&A session of the meeting, we will answer questions as they come in. Information regarding the ability of stockholders to ask questions during the Annual Meeting and related rules of conduct at the Annual Meeting will be posted on our investor relations page (investors.coopertire.com) in advance of the Annual Meeting. Similarly, matters addressing technical and logistical issues, including technical support during the Annual Meeting and related to accessing the Annual Meeting’s virtual meeting platform, will be available at www.virtualshareholdermeeting.com/CTB2020. Attendance and Participation Our completely virtual Annual Meeting will be conducted on the internet via live webcast. You will be able to participate in the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/CTB2020. You also will be able to vote your shares electronically at the Annual Meeting. TABLE OF CONTENTS All stockholders of record at the close of business on March 13, 2020 (the “record date”), or their duly appointed proxies, may participate in the Annual Meeting. To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials (“Notice”), on your proxy card or on the instructions that accompanied your proxy materials. The Company encourages you to access the Annual Meeting before the start time of 10:00 a.m., Eastern Daylight Time on Friday, May 8, 2020. Please allow ample time for online check-in, which will begin at 9:45 a.m., Eastern Daylight Time, on Friday, May 8, 2020. The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the meeting. Stockholders may submit questions during the Annual Meeting. If you wish to submit a question, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/CTB2020, type your question into the “Ask a Question” field, and click “Submit.” Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints. Questions regarding personal matters, including those related to employment or products are not pertinent to meeting matters and therefore will not be answered. We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Stockholder Meeting log-in page. Each share of the Company’s Common Stock will be entitled to one vote on each matter. Only stockholders of record at the close of business on March 10, 2017, (the “record date”)the record date will be eligible to vote at the Annual Meeting. Meeting online at www.virtualshareholdermeeting.com/CTB2020. To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials (“Notice”), on your proxy card or on the instructions that accompanied your proxy materials. The Company encourages you to access the Annual Meeting before the start time of 10:00 a.m., Eastern Daylight Time on Friday, May 8, 2020. Please allow ample time for online check-in, which will begin at 9:45 a.m., Eastern Daylight Time, on Friday, May 8, 2020. As of the record date, there were 52,910,82350,266,057 shares of Common Stock outstanding. The holders of a majority of the shares of Common Stock issued and outstanding, and present in person or represented by proxy, constitute a quorum. Abstentions and “broker non-votes” with respect to a proposal will be counted to determine whether a quorum is present at the Annual Meeting. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. “Broker non-votes” occur when an organization that holds shares for a beneficial owner has not received voting instructions with respect to the proposal from the beneficial owner. Whether such organization has the discretion to vote those shares on a particular proposal depends on the ballot item. If the organization that holds your shares does not have discretion and you do not give the organization instructions, the votes will be “broker non-votes,” which may have the same effect as votes against the proposal. Below is a summary of the vote threshold required for passage of each agenda item and the effect of abstentions and “broker non-votes.”

Agenda Item 1.1. Except in the case of a contested election, each nominee for election as a Director who receives a majority of the votes cast with respect to such Director’s election by stockholders will be elected as a Director. In the case of a contested election, the nominees for election as Directors who receive the greatest number of votes will be elected as Directors. Abstentions and “broker non-votes” are not counted for purposes of the election of Directors.

TABLE OF CONTENTS

Agenda Item 2.2. Although the Company’s independent registered public accounting firm may be selected by the Audit Committee of the Board of Directors without stockholder approval, the Audit Committee will consider the affirmative vote of a majority of the shares of Common Stock having voting power present in person or represented by proxy at the Annual Meeting to be a ratification by the stockholders of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2017.2020. As a result, abstentions will have the same effect as a vote cast against the proposal. As a routine matter, we do not expect “broker non-votes” with respect to this proposal.

Agenda Item 3. Although the advisory vote to approve named executive officer compensation is non-binding, the advisory vote allows our stockholders to express their opinions regarding named executive officer compensation. The Board will consider the affirmative vote of a majority of the shares of Common Stock having voting power present in person or represented by proxy at the Annual Meeting as approval of the compensation of the Company’s named executive officers for fiscal 2016.year 2019. Abstentions are counted as votes against and “broker non-votes” are not counted for purposes of the advisory vote to approve named executive officer compensation. As a result, if you own shares through a bank, broker-dealer, or similar organization, you must instruct your bank, broker-dealer, or other similar organization to vote in order for them to vote your shares.Agenda Item 4. Although

Shares held in your name as the advisorystockholder of record may be voted electronically during the Annual Meeting. If you choose to vote to recommend the frequency of advisory votes on the Company’s named executive officer compensation is non-binding, the advisory vote allows our stockholders to express their opinions regarding the frequency of stockholder votes regarding the Company’s named executive officer compensation. The Board will consider the option receiving the greatest number of votes (every one, two or three years) of theyour shares of Common Stock having voting power present in person or represented by proxy atonline during the Annual Meeting, asplease follow the frequency recommended by stockholders. However, because this vote is advisory and not bindinginstructions provided on the Board ofNotice to log in to www.virtualshareholdermeeting.com/CTB2020. You will need the 16-digit control number included on your Notice, on your proxy card, or on the instructions that accompanied your proxy materials. Even if you plan to participate in the Annual Meeting, the Company strongly recommends that you vote your shares in any way,advance as described below so that your vote will be counted if you later decide not to attend the Board may decide that it is in the best interests of our stockholders and our Company to hold an advisory vote on named executive officer compensation more or less frequently than the option recommended by our stockholders. Abstentions and “broker non-votes” will have no effect on this proposal.Annual Meeting electronically. Stockholders may vote by completing, properly signing, and returning the accompanying proxy card, or by attendingparticipating and voting electronically at the Annual Meeting.Meeting online at www.virtualshareholdermeeting.com/CTB2020. If you properly complete and return your proxy card in time to vote, your proxy (one of the individuals named in the proxy card) will vote your shares as you have directed. If you sign and return the proxy card but do not indicate specific choices as to your vote, your proxy will vote your shares (i) to elect the nominees listed under “Nominees for Director,” (ii) for the ratification of the selection of the Company’s independent registered public accounting firm and (iii) for approval of the compensation of the Company’sCompany's named executive officers for fiscal year 2016 and (iv) for advisory votes on the Company’s named executive officer compensation to occur “every year.”2019. Stockholders of record and participants in certain defined contribution plans sponsored by the Company (see below) may also vote by using a touch-tone telephone to call 1-800-690-6903, or by the Internet by accessing the following website:http://www.proxyvote.com. Voting instructions, including your stockholder account number and personal proxy control number, are contained on the accompanying proxy card. You will also use this accompanying proxy card if you are a participant in the following defined contribution plans sponsored by the Company: | ● | Spectrum Investment Savings Plan; |

| ● | Pre-Tax Savings Plan (Texarkana Represented Employees); or |

| ● | Pre-Tax Savings Plan (Findlay Represented Employees). |

Spectrum Investment Savings Plan; Pre-Tax Savings Plan (Texarkana Represented Employees); or Pre-Tax Savings Plan (Findlay Represented Employees). Those stockholders of record who choose to vote by telephone or Internet must do so no later than 11:59 p.m., Eastern Daylight Time, on May 4, 2017.7, 2020. All voting instructions from participants in the defined contribution plans sponsored by the Company and listed above must be received no later than 5:0011:59 p.m., Eastern Daylight Time, on May 3, 2017.5, 2020.

A stockholder may revoke a proxy by filing a notice of revocation with the Secretary of the Company, or by submitting a properly executed proxy card bearing a later date. A stockholder may also revoke a previously executed proxy (including one submitted by Internet or telephone) by attendingparticipating and voting electronically at the Annual Meeting online at www.virtualshareholdermeeting.com/CTB2020, after requesting that the earlier proxy be revoked. AttendanceOnline participation at the Annual Meeting, without further action on the part of the stockholder, will not operate to revoke a previously granted proxy card. If

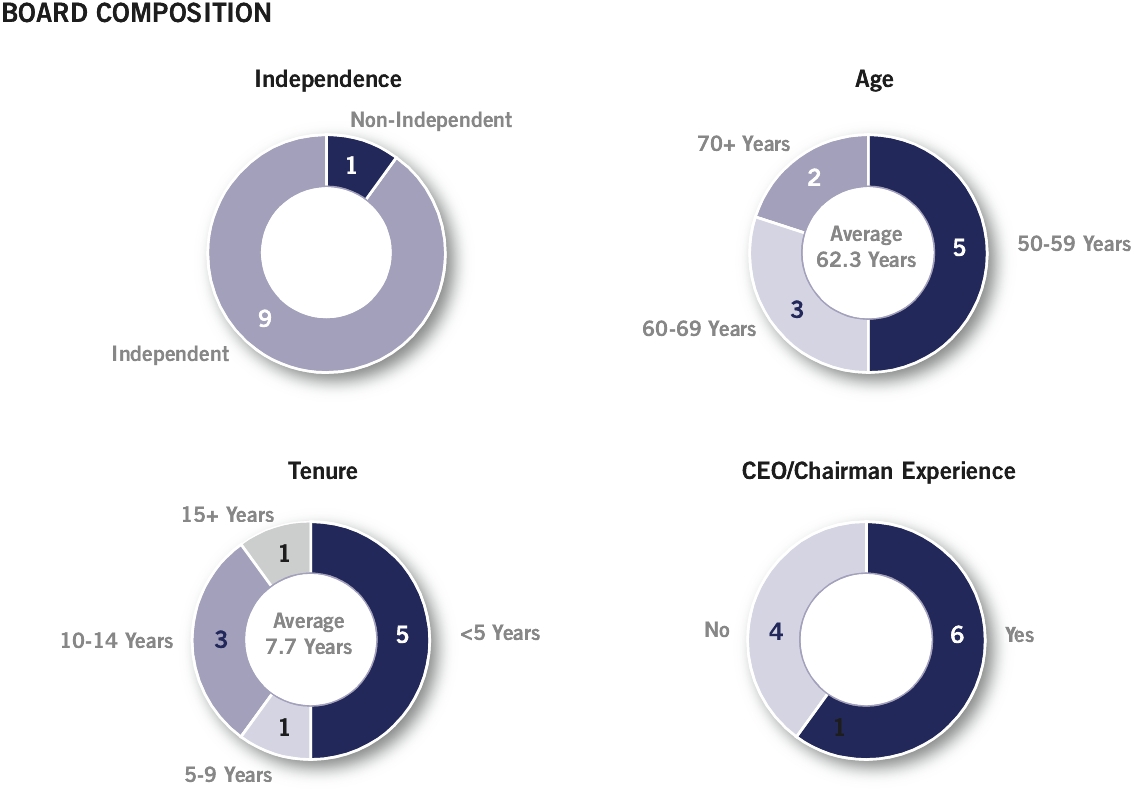

TABLE OF CONTENTS Our Board is comprised of members with a variety of qualifications, skills, business knowledge and experiences, backgrounds, viewpoints and expertise to provide effective oversight of management and the shares are heldCompany. Board of Directors | | | 10 | | | 9 | | | 5 | Audit Committee | | | 4 | | | 4 | | | 4 | Compensation Committee | | | 4 | | | 4 | | | 4 | Nominating and Governance Committee | | | 4 | | | 4 | | | 3 |

The Company is committed to environmental responsibility and the health and safety of its employees, contractors and the community, as well as the long-term, sustainable health and growth of the Company. The Company's organization structure allows it to supervise and audit, using a combination of internal and external resources, environmental activities, planning and programs to promote compliance with applicable environmental, health and safety (“EHS”) requirements and Company standards. Additionally, the Company has implemented a global EHS management system to predictably and sustainably manage EHS and to hold management accountable for non-compliance. The Company also participates in activities concerning general industry environmental matters, including being a founding member of the Tire Industry Project and the Global Platform for Sustainable Natural Rubber. TABLE OF CONTENTS At Cooper Tire, we strive to attract, engage and retain the most talented and high-performing employees. We provide an environment where the most outstanding people in the nameworld feel welcome, respected and valued for who they are and for their contributions. We are passionate about helping to raise the level of a bank, brokerrespect and inclusion in our communities. We are an equal employment opportunity employer. We embrace and encourage Cooper Tire people's differences in age, color, disability, ethnicity, family or marital status, gender identity or expression, language, national origin, physical and mental ability, political affiliation, race, religion, sexual orientation, socio-economic status, veteran status and other holdercharacteristics that make each of record,them unique. RECOGNIZED FOR BOARDROOM DIVERSITY The Company has been honored by the stockholder must obtain a proxy executed in his or her favor fromWomen’s Forum of New York and 2020 Women on Boards for raising the holder of record to be able to vote at the Annual Meeting.AGENDA ITEM 1

ELECTION OF DIRECTORS

In accordance with the Restated Certificate of Incorporation of the Company, thebar for gender-diverse boards. The Company's Board of Directors includes 30 percent female representation, exceeding the national average.

RECOGNIZED FOR LGBTQ EQUALITY The Company earned a score of 100% on the Human Rights Campaign’s Corporate Equality Index, a national benchmarking survey and report measuring corporate policies and practices related to LGBTQ equality in the workplace, and has fixed the total number of Directors to be elected at the Annual Meeting at eight. All eight of our Directors standing for reelection have a term that expires at this Annual Meeting and each has consented to stand for reelection. At this Annual Meeting, eight Directors are being elected to serve for a term of office that will expire at the Annual Meeting of Stockholders in 2018. In the event that anybeen named one of the nominees becomes unavailableBest Places to serve as a Director before the Annual Meeting, the Board of Directors may designate a new nominee, and the persons named as proxies will voteWork for that substitute nominee.LGBTQ Equality. TABLE OF CONTENTS The Board of Directors recommends that stockholders vote FOR the eight nominees for Director.

NOMINEES FOR DIRECTOR | AGENDA ITEM 1 | | | | ELECTION OF DIRECTORS | | |  | | THOMAS P. CAPO | Non-Executive Chairman

In accordance with the Restated Certificate of Incorporation of the Board,Former Chairman of the Board,Dollar Thrifty Automotive Group, Inc. | | Mr. Capo, age 66, served as Chairman ofCompany, the Board of Dollar Thrifty Automotive Group, Inc., a vehicle rental company, from October 2003Directors has fixed the total number of Directors to November 2010.be elected at the Annual Meeting at nine. Mr. Capo, was a Senior Vice President and Treasurer of DaimlerChrysler Corporation, an automobile manufacturer, from November 1998 until August 2000. From November 1991 to October 1998, he was Treasurer of Chrysler Corporation, an automobile manufacturer. Prior to holding these positions, Mr. Capo served as Vice President and Controller of Chrysler Financial Corporation, a finance company. Mr. Capo currently serves as a director of Lear Corporation, and, until its sale in November 2012, hewho has served as a director of Dollar Thrifty Automotive Group, Inc. Mr. Capo has a B.S. in Accounting and Finance, an M.A. in Economics, and an M.B.A. in Finance, each from the University of Detroit Mercy. Mr. Capo’s public company board and committee experience, includingDirector since 2007, is not standing for reelection when his current term expires at the board chairman level, executive managementAnnual Meeting. All nine of our Directors standing for reelection have a term that expires at this Annual Meeting and leadership experience, especiallyeach has consented to stand for reelection. At this Annual Meeting, nine Directors are being elected to serve for a term of office that will expire at the Annual Meeting of Stockholders in finance, treasury, capital markets, M & A, strategy development, capital restructuring, financial reporting and compliance, including his service2021. In the event that any of the nominees becomes unavailable to serve as a public company treasurer and controller, and education qualify him to continue serving as a member ofDirector before the Annual Meeting, the Board of Directors.Directors may designate a new nominee, and the persons named as proxies will vote for that substitute nominee. | | | | | The Board of Directors recommends that stockholders vote FOR the nine nominees for Director. | |

NOMINEES FOR DIRECTOR (CONT.) | | | | | |  | | STEVEN M. CHAPMAN |

Group Vice President,

China and Russia,

Cummins, Inc. | | | | | | Mr. Chapman, age 63,66, has served as Group Vice President, China and Russia, for Cummins, Inc. since 2009. Cummins designs, manufactures, and markets diesel engines and related components and power systems. Mr. Chapman has been with Cummins since 1985 and served in various capacities, including as Group Vice President, Emerging Markets & Businesses, President of Cummins’ International Distribution Business, Vice President of International, and Vice President of Southeast Asia and China. He is also a senior advisor to the US-China Industrial Cooperation Partnership, a private equity fund managed by Goldman Sachs. Mr. Chapman graduated from St. Olaf College with a B.A. in Asian Studies and from Yale University with a M.P.P.M. in Management. Mr. Chapman’s education, board member experience, and business management experience in operations and international operations qualify him to continue serving as a member of the Board of Directors. |

| |  Director Since 2016 | 2006 | | | | | |  | | SUSAN F. DAVIS |

Former Executive Vice President,

Asia-Pacific Region,

Johnson Controls | | | | | | Ms. Davis, age 63,66, served as Executive Vice President of the Asia-Pacific Region for Johnson Controls from September 2015 until her retirement in October 2016. Johnson Controls is a globally diversified technology and industrial leader serving customers in more than 150 countries. Ms. Davis has served in positions of increasing responsibility within Johnson Controls. She was named Vice President of Organizational Development in 1993. The following year, she was appointed Corporate Vice President of Human Resources and was named Executive Vice President of Human Resources in 2005. She was named Executive Vice President & Chief Human Resources Officer in 2012. She joined the company in 1985, following its acquisition of Hoover Universal, where she began her career in 1983 as a strategic planner for the automotive seating and plastics machinery business. Ms. Davis holds a Master of Business Administration (MBA) degree from the University of Michigan. She graduated magna cum laude with a Master of Arts degree and magna cum laude with a Bachelor of Arts, both from Beloit College. She holds a Master of Business Administration (MBA) degree from the University of Michigan. Ms. Davis currently serves as director of Quanex Corporation.Corporation, and as an advisor to Colorado State University. Ms. Davis’s education, board member experience, and business management experience qualify her to continue serving as a member of the Board of Directors. |

TABLE OF CONTENTS NOMINEES FOR DIRECTOR (CONT.) | | | | Ms. Dickson, age 55, is currently serving as President, Manitoba Harvest, a global company that manufactures and markets plant-based-protein food and beverages. Ms. Dickson joined Manitoba Harvest in December 2019, after the acquisition of the business by Tilray, Inc. Prior to Manitoba Harvest, Ms. Dickson served as Senior Vice President for Mattel, Inc., a global learning, development, and play company, and President of its American Girl subsidiary from February 2016 through December 2018. Prior to Mattel, Ms. Dickson served as Chief Marketing Officer for News America Marketing, Inc., a consumer-focused marketing business from February 2015 through February 2016. Prior to News America Marketing, Inc., Ms. Dickson served in increasingly responsible roles over more than 23 years, at General Mills, Inc., a global manufacturer and marketer of branded consumer foods. Her leadership there included Vice President, Marketing Excellence, and Vice President / Business Unit Director for global brands including Betty Crocker, Pillsbury, and Old El Paso. Ms. Dickson holds a B.S. degree from the United States Air Force Academy, and a Master of Business Administration (MBA) from Univ. of California, Los Angeles. She served as an officer in the U.S. Air Force, where she achieved the rank of Captain. Ms. Dickson’s education, business leadership, business management and marketing experience qualify her to continue as a member of the Board of Directors. |

NOMINEES FOR DIRECTOR (CONT.) | | | | | |  | | JOHN J. HOLLAND |

President,

Greentree Advisors LLC | | | | | | Mr. Holland, age 67,70, has served as President of Greentree Advisors LLC since 2005. Greentree Advisors LLC provides business advisory services. Mr. Holland served as President of The International Copper Association (ICA) from 2012 to 2015. The ICA is a marketing and trade organization for the global copper industry. Mr. Holland served as President, Chief Operating Officer, and Chief Financial Officer of MMFX Technologies Corporation from September 2008 until October 2009. MMFX Technologies is an inventor and manufacturer of nano technology steel. Prior to that, he was Executive Vice President and Chief Financial Officer of Alternative Energy Sources, Inc., an ethanol producer, from August 2006 until June 2008. Mr. Holland previously was employed by Butler Manufacturing Company, a producer of pre-engineered building systems, supplier of architectural aluminum systems and components, and provider of construction and real estate services for the non-residential construction market, from 1980 until his retirement in 2004. Prior to his retirement from Butler, Mr. Holland served as Chairman of the Board from 2001 to 2004, as Chief Executive Officer from 1999 to 2004, and as President from 1999 to 2001. Mr. Holland is also a director of SAIA, Inc., (formerly SCS Transportation, Inc.), and Cornerstone Building Brands, Inc. (formerly NCI Buildings Systems Inc.). Mr. Holland holds B.S. and MBA degrees from the University of Kansas. Mr. Holland’s education, board member experience, and business management experience in operations and accounting, including his service as a chief executive officer and chief financial officer, qualify him to continue serving as a member of the Board of Directors. |

TABLE OF CONTENTS NOMINEES FOR DIRECTOR (CONT.) | |  Director Since 2016 | 2003 | | | | | |  | | BRADLEY E. HUGHES |

President and& Chief Executive Officer | | | | | | Mr. Hughes, age 55,58, has served as President & Chief Executive Officer since September 2016. He previously served the Company as Senior Vice President and Chief Operating Officer from January 2015 to September 2016; Senior Vice President and President-International Tire Operations from July 2014 to January 2015; Senior Vice President and Chief Financial Officer from SeptemberJuly 2014 to December 2014; Senior Vice President, Chief Financial Officer and Treasurer from July 2014 to September 2014; Vice President, Chief Financial Officer and Treasurer from November 2013 to July 2014 and Vice President and Chief Financial Officer from November 2009 to November 2013. Mr. Hughes was previously employed at Ford Motor Co. where he worked as Global Product Development Controller for Ford in Dearborn, Michigan; as Finance Director for Ford’s South America Operations in Sao Paulo, Brazil; as Director of European Business Strategy and Implementation, Cologne, Germany; as European Manufacturing Controller, Cologne, Germany; and in other corporate finance and treasury positions.July 2014. Mr. Hughes has a B.A. in business from Miami University and an MBA from the University of Michigan. Mr. Hughes’s education, extensive knowledge of the Company, international operations and business management experience qualify him to continue serving as a member of the Board of Directors. |

| | | | | | | Director Since | 2016Ms. Joubert, age 53, has served as Chief Financial Officer of Molson Coors Brewing Company since 2016. Molson Coors is a leading global brewer. Ms. Joubert was Executive Vice President and Chief Financial Officer of MillerCoors from 2012-2016 and served in a variety of increasingly responsible finance leadership roles at MillerCoors since 2003. A native of South Africa, Ms. Joubert holds bachelor’s degrees in commerce and accounting from the University of Witwatersrand in Johannesburg. She also serves on the Board of Directors of MillerCoors and Coors Brewing Company, subsidiaries of Molson Coors. Ms. Joubert’s education, board member experience, business management and finance experience qualify her to continue serving as a member of the Board of Directors. |

TABLE OF CONTENTS NOMINEES FOR DIRECTOR (CONT.) | | | |  | | GARY S. MICHEL | Senior Vice

President and Chief Executive Officer

President, Residential Heating, Ventilation

and Air Conditioning (HVAC) and Supply,

Ingersoll RandJELD-WEN Holding, Inc. | | | | | | Mr. Michel, age 54,57, has served as President and Chief Executive Officer of Ingersoll Rand’sJELD-WEN Holding, Inc. since June 2018. He also serves on JELD-WEN’s Board of Directors. JELD-WEN is one of the world's largest door and window manufactures with facilities in 20 countries. The company designs, produces and distributes an extensive range of interior and exterior doors, wood, vinyl and aluminum windows and related products used in new construction and remodeling of residential HVAC & Supply business since 2011; which includes brands suchand commercial structures. Prior to JELD-WEN, Mr. Michel served as Trane, American Standard, Ameristar,President and Nexia. Ingersoll Rand isCEO of Honeywell International Inc.’s Home and Building Technologies Strategic Business Unit, a $13 billion global business that enhances the qualitydeveloper of connected products and comfort of air insoftware for homes and buildings; transports and protects food and perishables, and increases industrial productivity and efficiency.buildings, from October 2017 until May 2018. Prior to Honeywell, Mr. Michel was with Ingersoll-Rand Company, a 32-year veterandiversified manufacturer and services provider of Ingersoll Rand, is a Senior Vice President of the companyclimate and refrigeration systems, industrial technologies and small electric vehicles, for more than three decades, serving most recently as senior vice president and president, Residential HVAC and Supply. He also servesserved as a member of its enterprise leadership team. He also leadsteam and led the Ingersoll Rand Sales Excellence Initiative, as well as serving as a co-lead of the company’s enterprise sustainability efforts. Mr. Michel began his tenure with Ingersoll Rand as an application engineer and went on to hold product, sales, and business management roles before moving into a series of leadership positions across various geographic and market segments, culminating in his current role. Mr. Michel holds a Bachelor of Science degree in Mechanical Engineering from Virginia Polytechnic Institute and State University and an MBA degree from the University of Phoenix. Mr. Michel’s education, board member experience, and business management experience qualify him to continue serving as a member of the Board of Directors. |

| | Director Since | 2015 | | | | | BRIAN C. WALKER  | | JOHN H. SHUEY | Former Chairman of the Board,

President and Chief Executive Officer

Amcast Industrial CorporationHerman Miller, Inc. | | | | | | Mr. Shuey,Walker, age 71, joined Amcast Industrial Corporation, a producer of aluminum components for the automotive industry and plumbing products for the construction industry, in 1991 as Executive Vice President. He was elected President and Chief Operating Officer in 1993, a director in 1994, Chief Executive Officer in 1995, and Chairman in 1997. Mr. Shuey58, served as Chairman of the Board, President and Chief Executive Officer through February 2001. Prior to joining Amcast,of Herman Miller, Inc., a global provider of office furniture and services, from 2004 until his retirement in 2018. Mr. ShueyWalker joined Herman Miller, Inc. in 1989 and served in various capacities, including as chief financial officer for two Fortune 500 companies.Chief Financial Officer, and Executive Vice President. Mr. Shuey has beenWalker holds a private investor since February 2001. Mr. Shuey has a B.S.bachelor's degree in Industrial Engineeringaccounting from Michigan State University and is a certified public accountant. Mr. Walker is also a director of Briggs and Stratton Corporation, Universal Forest Products, Inc. and Gentex Corporation, and serves as an MBA degree, both fromOperating Partner in Strategic Leadership with the University of Michigan.private equity firm, Huron Capital. Mr. Shuey’sWalker’s education, board member experience, and business management and financial managementfinance experience including service as chief financial officer for two Fortune 500 companies, as well as his service as a chief executive officer and in numerous leadership positions for many organizations, qualify him to continue serving as a member of the Board of Directors. | | | | | | | Director Since | 1996 |

TABLE OF CONTENTS NOMINEES FOR DIRECTOR (CONT.) | | | |  | | ROBERT D. WELDING |

Former Non-Executive Chairman,

Public Safety Equipment (Int’l) Limited | | | | | | Mr. Welding, age 68,71, served as the Non-Executive Chairman of Public Safety Equipment (Int’l) Limited, a manufacturer of highway safety and enforcement products, from January 2009 until his retirement in May 2010. Prior to that, he was President, Chief Executive Officer, and a director of Federal Signal Corporation, a manufacturer of capital equipment, from November 2003 until his retirement in 2007. Prior to holding those positions, Mr. Welding was Executive Vice President of BorgWarner, Inc., a U.S. automotive parts supplier, and Group President of BorgWarner’s Driveline Group from November 2002 until November 2003, and was President of BorgWarner’s Transmission Systems Division from 1996 to November 2002. Mr. Welding graduated from the University of Nebraska with a B.S. in Mechanical Engineering, holds an MBA from the University of Michigan, and is a graduate of Harvard Business School’s Advanced Management Program. Mr. Welding’s education, board member experience, and business management experience in strategy development, operations leadership, continuous improvement, product development, technology, and corporate leadership qualify him to continue serving as a member of the Board of Directors. | | | | | | | Director Since | 2007 |

Note: The beneficial ownership of the Directors and nominees in the Common Stock of the Company is shown in the table presented under the heading “Security Ownership of Management” in this proxy statement. TABLE OF CONTENTS | | | | | | RATIFICATION OF THE SELECTION OF THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | | Ernst & Young LLP served as the independent registered public accounting firm of the Company in 2019 and has been retained by the Audit Committee to do so in 2020. In connection with the audit of the 2020 financial statements, the Company has engaged Ernst & Young LLP to perform audit services for the Company. The Board of Directors has directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. | | | | Stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm is not required by the Company’s Bylaws or otherwise. However, the Board of Directors is submitting the selection of Ernst & Young LLP to the stockholders for ratification. If the stockholders do not ratify the selection, the Audit Committee will reconsider whether or not to retain the firm. In such event, the Audit Committee may retain Ernst & Young LLP, notwithstanding the fact that the stockholders did not ratify the selection, or select another nationally recognized public accounting firm without resubmitting the matter to the stockholders. Even if the selection is ratified, the Audit Committee reserves the right in its discretion to select a different nationally recognized public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders. | | | | | The Board of Directors recommends that stockholders vote FOR the ratification of the selection of the Company’s independent registered public accounting firm. | |

AGENDA ITEM 2RATIFICATIONTABLE OF THE SELECTION OF THE COMPANY’S INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Ernst & Young LLP served as the independent registered public accounting firm of the Company in 2016 and has been retained by the Audit Committee to do so in 2017. In connection with the audit of the 2017 financial statements, the Company has engaged Ernst & Young LLP to perform audit services for the Company. The Board of Directors has directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the Annual Meeting.

Stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm is not required by the Company’s Bylaws or otherwise. However, the Board of Directors is submitting the selection of Ernst & Young LLP to the stockholders for ratification. If the stockholders do not ratify the selection, the Audit Committee will reconsider whether or not to retain the firm. In such event, the Audit Committee may retain Ernst & Young LLP, notwithstanding the fact that the stockholders did not ratify the selection, or select another nationally recognized public accounting firm without resubmitting the matter to the stockholders. Even if the selection is ratified, the Audit Committee reserves the right in its discretion to select a different nationally recognized public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

The Board of Directors recommends that stockholders vote FOR the ratification of the selection of the Company’s independent registered public accounting firm.CONTENTS

AGENDA ITEM 3

PROPOSAL TO APPROVE, ON A NON-BINDING ADVISORY BASIS, THE

COMPANY’S NAMED EXECUTIVE OFFICER COMPENSATION

The Board of Directors is aware of the significant interest in executive compensation matters by investors and the general public. The Company is submitting this proposal, commonly known as a “say-on-pay” proposal, to stockholders. The Company is currently conducting say-on-pay votes every year and expects to hold the next say-on-pay vote in connection with its 2018 Annual Meeting of Stockholders, subject to the Board of Directors’ consideration of the outcome of the vote on Agenda Item 4 described in this proxy statement. As required under the Dodd-Frank Wall Street Reform and Consumer Protection Act and Section 14A of the Securities Exchange Act of 1934, or the Exchange Act, we are asking you to cast a non-binding advisory vote to approve the Company’s named executive officer compensation through the consideration of the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”

Our Compensation Committee has overseen the development and implementation of a compensation program that is discussed more fully in “Compensation Discussion and Analysis” and “Executive Compensation,” including the summary tables and narrative sections of this proxy statement.

| | | | | | PROPOSAL TO APPROVE, ON A NON-BINDING ADVISORY BASIS, THE COMPANY’S NAMED EXECUTIVE OFFICER COMPENSATION | | | | The Board of Directors is aware of the significant interest in executive compensation matters by investors and the general public. The Company is submitting this proposal, commonly known as a “say-on-pay” proposal, to stockholders. The Company is currently conducting say-on-pay votes every year and expects to hold the next say-on-pay vote in connection with its 2021 Annual Meeting of Stockholders. As required under the Dodd-Frank Wall Street Reform and Consumer Protection Act and Section 14A of the Securities Exchange Act of 1934, or the Exchange Act, we are asking you to cast a non-binding advisory vote to approve the Company’s named executive officer compensation through the consideration of the following resolution: | | | | “RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.” | | | | Our Compensation Committee has overseen the development and implementation of a compensation program that is discussed more fully in “Compensation Discussion and Analysis” and “Executive Compensation,” including the summary tables and narrative sections of this proxy statement. | | | | The Company’s compensation program emphasizes a pay-for-performance philosophy. Performance-based annual cash incentive and cash and equity long-term incentive programs, collectively, are the majority of the targeted annual compensation for our named executive officers. These programs are designed to: | | | | • | Drive the long-term financial and operational performance of the Company; | | | | • | Deliver value to our stockholders; | | | | • | Recognize and reward corporate, group and individual performance; | | | | • | Provide a pay package that reflects our judgment of the value of each officer’s position in the marketplace and the Company; and | | | | • | Attract and retain strong executive leadership. | | | | In executing a philosophy which begins with creating long-term value to stockholders, the Compensation Committee has established a framework for executive compensation that promotes a culture of performance and accountability with due consideration to risk management, transparency, and the need to adjust to rapidly changing market conditions. The program is heavily weighted toward pay at risk, with limited executive perquisites and benefits and clear line of sight to the link between important Company strategic goals and the rewards for achieving those objectives. | | | | To further promote alignment with the interests of stockholders and a culture of enduring performance and accountability, the Company's executives have stock ownership requirements and are bound by a clawback policy which allows for the recoupment of incentive payments in certain circumstances. The fully independent Compensation Committee believes that the executive compensation program is an essential factor in the Company's strengthening of its leadership team and competitive position in the marketplace, both of which lead to business continuity and long-term value creation. | | | | Because your vote is advisory, it will not be binding upon the Company, the Compensation Committee, or the Board of Directors. However, we value stockholders’ opinions, and the Board expects to carefully consider the outcome of the advisory vote on named executive officer compensation. | | | | | The Board of Directors recommends that the stockholders vote FOR approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers for fiscal year 2019. | |

TABLE OF CONTENTS COMPENSATION DISCUSSION AND ANALYSIS This section describes Cooper Tire’s executive compensation philosophy, program design, components, and decision making process for the compensation of the named executive officers listed below. Bradley E. Hughes | | | President & Chief Executive Officer | Christopher J. Eperjesy | | | Senior Vice President & Chief Financial Officer | Stephen Zamansky | | | Senior Vice President, General Counsel & Secretary | John J. Bollman | | | (Former) Senior Vice President & Chief Human Resources Officer |

1

| Mr. Bollman joined the Company on March 21, 2017 and terminated his employment with the Company on December 2, 2019, and Mr. Zamansky has been overseeing the Company's human resources operations on an interim basis, in addition to his other responsibilities, since such date. |

COMPANY PERFORMANCE HIGHLIGHTS Cooper Tire responded well to challenging conditions, delivering improved operating profit, operating profit margin and operating cash flows in 2019. Operating profit was $174 million, or 6.3 percent of sales, with operating profit margin improving throughout the year from 4.3 percent in the first quarter to 8.5 percent in the fourth quarter. Additionally, operating cash flow improved by $33 million, which helped fund our strategic initiatives. All of this was achieved despite headwinds from net new tariffs and restructuring costs. Over the past year, we have continued to make significant progress on our strategic plan initiatives: Expanding our retail presence: A key initiative is to make Cooper Tire products available at a greater number of retail points where consumers want to shop for tires. In the U.S., we have added thousands of additional points of sale over the last 12 months, including added or expanded business with key national retailers and strong growth on e-commerce platforms. Securing strategic Original Equipment (OE) fitments: We have been selectively pursuing strategic OE tire fitments, and have since announced multiple fitments with luxury auto brand Mercedes-Benz. Expanding our Truck and Bus Radial (TBR) business: Another key strategy includes the expansion of our TBR tire business driven by the introduction of a Cooper TBR tire lineup to augment our Roadmaster brand. This Cooper Tire brand launched and immediately got off to a strong start in both the replacement and OE markets. Accelerating the cadence of compelling new product launches: Cooper Tire has been working hard to increase the pace of new product introductions to assure that we continually have fresh, compelling new products hitting the market, especially in key segments. We’ve been delivering on this promise with new product launches such as the Discoverer AT3, Starfire Solarus, and Discoverer EnduraMax. Building out a digital marketing capability and enhancing brand awareness: Cooper Tire has developed a digital marketing capability with a dedicated team focused on leveraging digital to drive our business. We have continued to invest in consumer brand awareness efforts and launched a new campaign including television, digital and print advertising featuring our new Uncle Cooper spokesperson. Strengthening our global manufacturing footprint: Cooper has been evaluating and upgrading our global manufacturing footprint to have the right technology and capabilities, with the right production capacity in the right locations, while also enhancing the competitiveness of our cost structure. In 2019, we ceased light vehicle tire production at our high-cost Melksham, England plant and transitioned production of these tires to other, lower-cost facilities in our network. In Asia, we launched a joint venture TBR tire plant in Vietnam. Finally, in early 2020, in Latin America, we bought out our joint venture partner in Mexico to take full ownership to better leverage that low-cost facility. TABLE OF CONTENTS COMPENSATION HIGHLIGHTS The Company's compensation program emphasizes a pay-for-performance philosophy. The performance-based annual cash incentive and long-term cash and equity incentive programs, collectively, are the majority of the targeted annual compensation for our named executive officers. These programs are designed to: | ● | drive the long-term financialDrive the short and operational performance of the Company; |

| ● | deliver value to our stockholders; |

| ● | recognize and reward corporate, group and individual performance; |

| ● | provide a pay package that reflects our judgment of the value of each officer’s position in the marketplace and the Company; and |

| ● | attract and retain strong executive leadership. |

In executing a philosophy which begins with creating long-term financial and operational performance of the Company;

Deliver value to stockholders,our stockholders; Recognize and reward corporate, group and individual performance; Provide a pay package that reflects our judgment of the Compensation Committee has established a framework for executive compensation that promotes a culturevalue of performance and accountability with due consideration to risk management, transparency, and the need to adjust to rapidly changing market conditions. The program is heavily weighted toward pay at risk, with limited executive perquisites and benefits and clear line of sight to the link between important Company strategic goals and the rewards for achieving those objectives.To further promote alignment with the interests of stockholders and a culture of enduring performance and accountability, the Company’s executives have stock ownership requirements and are bound by a clawback policy which allows for the recoupment of incentive payments in certain circumstances. The fully independent Compensation Committee believes that the executive compensation program is an essential factor in the Company’s strengthening of its leadership team and competitiveeach officer's position in the marketplace both of which lead to business continuity and long-term value creation.

Because your vote is advisory, it will not be binding upon the Company, the Compensation Committee, or the Board of Directors. However, we value stockholders’ opinions, and the Board will carefully considerCompany; and

Attract and retain strong executive leadership. The table below reflects the outcome of the advisory vote on2019 compensation package (base salary, target annual incentive plan (“AIP”) award and target long-term incentive plan (“LTIP”) award for each named executive officerofficer. We believe this table provides a simple and straightforward picture of 2019 compensation. The Board of Directors recommends that the stockholders vote FOR approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers for fiscal year 2016.

AGENDA ITEM 4

TO RECOMMEND, ON A NON-BINDING ADVISORY BASIS, THE FREQUENCY OF ADVISORY

VOTES ON THE COMPANY’S NAMED EXECUTIVE OFFICER COMPENSATON

Section 14A of the Exchange Act requires the Company to include in its proxy statement a non-binding advisory vote on the Company’s named executive officer compensation not less frequently than once every three years. Section 14A also requires us to include in our proxy statement this year a separate non-binding advisory vote regarding whether the non-binding advisory vote on named executive officer compensation should be held every one, two or three years. The proposal gives stockholders the opportunity to cast a non-binding, advisory vote to determine the frequency of advisory votes on the Company’s named executive officer compensation.

The Board of Directors has concluded that holding an annual advisory vote has been and will continue to be the most effective means for conducting and responding to a say-on-pay vote. Conducting an annual stockholder vote on named executive officer compensation provides stockholder input on named executive officer compensation practices and allows the Company to respond to stockholders concerns on an annual basis.

The accompanying proxy card allows stockholders to recommend that the advisory vote on the Company’s named executive officer compensation occur every one, two, or three years, or to abstain from voting on the matter. You are not voting to approve or disapprove the Board’s recommendation. The option receiving the greatest number of votes (every one, two or three years) will be considered the frequency recommended by stockholders. Because the vote is advisory, it will not be binding upon the Company, the Compensation Committee or the Board of Directors. However, we value stockholders’ opinions, and the Board will carefully consider the outcome of the advisory vote on the frequency of the advisory vote on named executive officer compensation.

The Board of Directors recommends that the stockholders vote for an advisory vote on the Company’s named executive officer compensation to occur EVERY YEAR.

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

Cooper Tire’s executive compensation program for its named executive officers is driven by our financial and strategic goals and the principle of pay for performance. The compensation program, which primarily consists of a base salary and performance-based cash incentive and equity awards, is built upon many of the principles and governance practices highlighted below.

Bradley E. Hughes | | | $995,000 | | | $1,194,000 | | | $3,980,000 | | | $6,169,000 | Christopher J. Eperjesy | | | $500,000 | | | $375,000 | | | $950,000 | | | $1,825,000 | Stephen Zamansky | | | $480,000 | | | $312,000 | | | $792,000 | | | $1,584,000 | John J. Bollman | | | $425,000 | | | $276,250 | | | $616,250 | | | $1,317,500 |

1

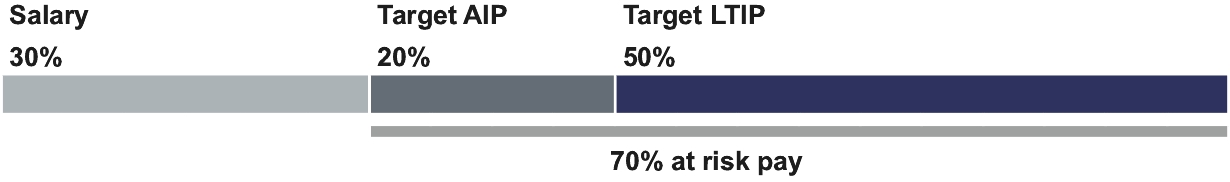

| Executive Compensation Design and Governing Principles | | | | | | ● | Pay is tied to performance: | | | | | | | - | Approximately 83%Salary in effect as of the CEO’s target annual compensation and 70% of the other named executive officers’ target annual compensation is at-risk and varies with performance against incentive goals as well as performance of Company stock. | | | | | | | - | There is an appropriate balance of annual and long-term incentives, and metrics used in the annual plan are different from the metrics used in the long-term incentive plan. | | | | | | | - | The annual incentive plan12/31/2019 for theall named executive officers with the exception of Mr. Bollman whose salary is reflected as of 12/2/2019, the date he left the Company. |

2

| AIP target percentage multiplied by the base salary in effect at the end of the year. The actual target award is based uponon salary actually earned during the achievement of established corporate performance goals.year. |

3

| | | | | | - | Two-thirdsLTIP target percentage multiplied by the base salary in effect at the end of the long-term opportunityyear. The actual 2019-2021 grant is based on the achievementLTIP target percentage multiplied by base salary at the time of established corporate performance goals.the grant. |

AIP results were approved at 119.4% of target | | | Performance against pre-established operating profit and free cash flow targets resulted in a formulaic outcome relative to target levels. The Committee made adjustments for certain unique and non-recurring events as described below, resulting in payout levels at 119.4% of target. | The 2019 measurement period for the LTIP was approved at 87.7% of target | | - | Dividend equivalents are not accrued or paid on performance awards that are not notionally earned. | | | | | | ● | Executives who participate in the long-term incentive plan are required to meet minimum levels of stock ownership and status of stock ownership is reviewed on an annual basis. | | | | | | ● | None of the named executive officers has an employment agreement. | | | | | | ● | Executive officers, including named executive officers, receive the same group benefits as other salaried employees, including health, life insurance, disability, and retirement benefits. They are also eligible for a non-qualified supplementary benefit plan designed to restore 401(k) benefits lost due to Internal Revenue Code (“Code”) statutory limits and a deferred compensation plan which does not provide any fixed, above-market earnings opportunity. | | | | | | ● | Executive officer perquisites are limited and reviewed annually. There are no tax gross-ups on perquisites other than for travel expenses of a spouse when accompanying an executive to participate in business-related activities. | | | | | | ● | The Company maintainsdelivered net income and return on invested capital results which resulted in a “double trigger” requirementformulaic outcome relative to target levels. The Committee made adjustments for change in control severance benefitscertain unique and for the acceleration of time-based equity awards, including restricted stock units and stock options (provided the awards are assumed or replaced with substantially equivalent awards). | | | | | | ● | There are no excise tax gross-up provisions upon a change in control. | | | | | | ● | The Compensation Committee generally designs and administers the executive compensation programs to maximize tax deductibility of executive compensation paid to the named executive officers. | | | | | | Benchmarking Philosophy and Risk Management | | | | | | ● | The Compensation Committee references the market median with respect to establishing compensation levels for the named executive officers. | | | | | | ● | To align with investor expectations and changes in the Company’s business and market practice, compensation peer groups are regularly evaluated. | | | | | | ● | The Compensation Committee monitors all equity grants under the 2014 Incentive Compensation Plan, and the Company’s three-year average burn rate is below the mean burn rate for the Russell 3000 companies in GICS group 2510. | | | | | | ● | The compensation program risk evaluation process is formalized, including an annual review of plansnon-recurring events as described below, resulting in the “Compensation-Related Risk Assessment” on page 23. Risk mitigation is incorporated into plan design, including capping both annual and long-term incentive plan payouts. | | | | | | ● | The Compensation Committee regularly reviews all formsnotionally earned awards at 87.7% of compensation, including all cash and equity-based compensation grants, non-qualified account balances, and payments due upon termination of employment. | | | | | | ● | The Board has an established policy for recoupment of annual and long-term incentive compensation in the event of a restatement of reported financial results or if an employee has engaged in unethical conduct detrimental to the Company. | | | | | | ● | The Board has adopted an anti-hedging and anti-pledging policy. | | | | | | ● | Our executive compensation consultant is retained directly by and reports to the Compensation Committee, does not provide any services to management, and had no prior relationship with our CEO or any other named executive officer. | | | target. |

TABLE OF CONTENTS

2016 Financial Results

The Company ended 2016 in a very strong position, increasing year-over net income by 16.7% from $213 million to $248 million and year-over-year operating profit by 8.4% from $354 million to $384 million. The Company also delivered a record operating profit margin of 13.1% of sales and an increase in unit volume of 2.6% from 2015 to 2016. In addition to these accomplishments, we remained good stewards of capital as reflected in the return on invested capital shown below.

Subsequent to the setting of annual targets for the 2016 plan year, the Company made the decision to offer a lump-sum pension settlement opportunity to certain former employees to reduce future pension liability. As a result of such offers, which were paid out of pension plan assets, the Company incurred non-cash pension settlement charges of $11.5 million. The Compensation Committee determined to exclude the impact of such charges from the calculation of incentive awards. The performance results shown below include an $11.5 million adjustment for the successful consummation of the lump-sum pension settlements.

Corporate Performance Metrics* | | 2016 Targets | | 2016 Performance

Results | | 2016 Reported

Results | | | | | | | | | | Operating Profit | | $370,000,000 | | $395,849,000 | | $384,387,000 | | | | | | | | | | Free Cash Flow | | $75,000,000 | | $111,063,000 | | $111,063,000 | | | | | | | | | | Net Income | | $227,000,000 | | $256,087,000 | | $248,381,000 | | | | | | | | | | Return on Invested Capital | | 15.0% | | 19.4% | | 18.9% |

| * | For more information about how these performance metrics are calculated and reconciliations to amounts presented in the 2016 Form 10-K, see “Incentive Compensation – Performance Metrics for 2016” on pages 15 and 16. |

Our Executive Officer Compensation Program Is Administered by the Compensation Committee

The Compensation Committee is responsible for performing the duties of the Board of Directors relating to the compensation of our executive officers and other senior management. During 2016, our named executive officers were Mr. Bradley E. Hughes, President and Chief Executive Officer; Mr. Roy V. Armes, former Chairman, Chief Executive Officer, and President; Ms. Ginger M. Jones, Senior Vice President and Chief Financial Officer; Ms. Brenda S. Harmon, Senior Vice President and Chief Human Resources Officer; and Mr. Stephen Zamansky, Senior Vice President, General Counsel and Secretary. Mr. Hughes was named President and Chief Executive Officer effective September 1, 2016, following Mr. Armes’s retirement on August 31, 2016. Prior to that date, Mr. Hughes served as our Senior Vice President and Chief Operating Officer. Subsequent compensation information will reflect Mr. Armes’s employment for a partial year.

With input, as appropriate, from management and our outside executive compensation consultant, the Compensation Committee reviews and approves all elements of our executive compensation program. Management is responsible for making recommendations to the Compensation Committee regarding executive officer compensation (except with respect to the CEO’s compensation) and effectively implementing our executive compensation program, as approved by the Compensation Committee.

The Compensation Committee retained Exequity LLP as its executive compensation consultant in 2016 and utilized data from Aon Hewitt, an outside compensation consultant, for pay benchmarking.

Additional information about the role and processes of the Compensation Committee is presented under the heading “Executive Compensation Consultant Disclosure” and “Meetings of the Board of Directors and Its Committees - Compensation Committee” in this proxy statement.

Executive Compensation Philosophy and Approach

The Cooper Tire executive officer compensation program is designed to deliver value to our stockholders by driving long-term financial and operational performance. To accomplish this goal, we have structured our executive compensation program to attract, motivate, and retain the caliber of leadership required to meet these objectives. In the following sections, we will address our benchmarking process and philosophy, how we set compensation levels, and the separate, but integrated elements of our program.

Compensation Peer Groups

The Compensation Committee annually analyzes market benchmark data regarding base salary and annual and long-term incentive opportunities and periodically evaluates market benchmark data regarding other compensation elements. The Compensation Committee uses benchmarking data to assess market pay levels and program design. For each element of compensation and in the aggregate, the Committee sets compensation targets near the middle of the range offered by comparable companies.

Peer Group for Pay Level Benchmarking - For 2016 officer pay level, we engaged Aon Hewitt to provide general industry data on 104 companies with revenues between $1.57 billion and $5.9 billion. The median revenue of these 104 companies was approximately $3.06 billion. As an additional benchmark, we also conducted a review and analysis of compensation data for the CEO and CFO positions in the peer group listed below using 2016 proxy information.

Peer Group for Program Design Benchmarking - For purposes of benchmarking executive compensation program design, the Committee periodically reviews a group of 17 companies (listed below) whose annual revenues range from approximately 50% to 250% of our revenues and who generally have similar characteristics with respect to capital-intensive manufacturing, producing and marketing a consumer-branded product, focusing on technology-driven products, and managing international operations. The median revenue for the following companies was $3.3 billion in 2016.

American Axle & Manufacturing Holdings | Kennametal Inc. | Cooper-Standard Holdings Inc. | Leggett & Platt Incorporated | Crane Co. | Lennox International, Inc. | Dana Holding Corp. | Snap-on Incorporated | Dover Corp. | SPX Corp. | Flowserve Corporation | Steelcase Inc. | Gentex Corp. | The Timken Company | Harley-Davidson, Inc. | Tower International, Inc. | Harsco Corporation | |

Our Compensation Levels Are Set Considering Business Needs, Market Data and Other Factors

We use a comprehensive and structured approach in setting the compensation framework for all executive positions. We begin with a review of the Company’s overall strategy and the particular role each executive position is expected to play in achieving the goals of the Company. Starting with this foundation and with the assistance of the Compensation Committee’s executive compensation consultant, we obtain and review relevant market benchmark data for each position regarding base salary, annual cash incentive opportunities, and long-term incentive award levels. We then determine an appropriate range of compensation for each position by assessing the market data in conjunction with the valuation of the position’s impact and importance in setting and achieving the strategic objectives of the Company. Informed by a review of all current and previously granted forms of compensation, competitive market data, organization strategies, and individual performance assessments, the Compensation Committee uses its judgment, rather than a formulaic approach, in setting target compensation for each named executive officer each year.

13

COMPONENTS OF COMPENSATION

Elements of Our Compensation Program

We believe that our executive compensation program, by element and in total, best achieves our objectives. The majority of each named executive officer’sofficer's compensation opportunity is based on the achievement of important financial and strategic goals established at the beginning of the respective performance period. The primary elements of our executive compensation program, all key to the attraction, retention, and motivation of our named executive officers, are shown in the following table: | | | | | Base Salary | | | To value the competencies, skills, experience, and performance of individual executives. | | | Cash. Not “at risk.” Based on responsibility, internal equity, experience and performance. Reviewed annually. | | | | | | Annual Incentive CompensationPlan (AIP) | | | To motivate and reward executives for thebased on achievement of targetedagainst pre-established financial goals. | | | Cash award. Performance-based and “at risk.” Amount earned will vary based upon results achieved againston the extent to which annual goals (operating profit and free cash flow in 2016).are achieved. | | | | | | Long-Term Incentive CompensationPlan (LTIP) | | | To motivate and reward executivesthe named executive officers for the achievement of long-term goals and creation of stockholder value. | | Equity | A mix of equity and cash awards. Performance-basedawards, and “at risk.” Amount earned will vary depending upon results achieved against long-term incentive goals (net income and return on invested capital in 2016) and in the caseAward mix consists of restricted stock units (“RSUs”), performance-based stock units restricted stock units(“PSUs”), and stock option awards, Company stock performance.performance-based cash (“Performance Cash”), each weighted approximately one-third of the total award. |

Approximately 84% of the Chief Executive Officer’s (“CEO's”) target annual compensation and 70% of the other named executive officers' target annual compensation, on average, is at-risk and varies based on performance against incentive goals as well as the performance of Company stock. Pay Mix: Chief Executive Officer Pay Mix: “Other Named Executive Officer” Average COMPENSATION BEST PRACTICES The following table summarizes the current compensation best practices we have implemented, as well as those practices we avoid because we believe they do not serve the interests of our stockholders. ✔ | | | | Pay for performance | Non-Qualified Benefits✔ | | To attract | Generally provide named executive officers the levelsame welfare and retirement benefits as full-time employees | ✔ | | | Have robust stock ownership guidelines for senior executives | ✔ | | | The Compensation Committee directly engages a fully independent compensation consultant | ✔ | | | Have a robust clawback policy | ✔ | | | Generally maintain double trigger requirement for change in control severance benefits | ✔ | | | Mitigate risk in plan design and annually review plans and practices |

TABLE OF CONTENTS ✘ | | | Enter into employment agreements with the named executive officers | ✘ | | | Allow hedging or pledging of talent requiredCooper Tire & Rubber Company stock | ✘ | | | Provide dividend equivalents on performance awards that are not notionally earned | ✘ | | | Provide tax gross-ups upon a change in control | ✘ | | | Reprice or reload stock options |

At last year's Annual Meeting, stockholders voted approximately 92% in favor of our “say-on-pay” proposal. The Compensation Committee considered the vote to achieve strategic objectives and to promote continuity of leadership. | | Supplementary benefit plan to make up for qualified plan benefits lost due to limitsbe an endorsement of the Code. OpportunityCooper Tire & Rubber Company's executive compensation program and did not make any changes to participate in a non-qualified deferredour executive compensation plan. policies and practices that were specifically driven by the say-on-pay vote. | | | |

Base SalariesCOMPONENTS OF THE COMPENSATION PROGRAM

Each named executive officer has a target total compensation opportunity comprised of both fixed (base salary) and variable (annual and long-term incentive) compensation. In addition, named executive officers are eligible for welfare and retirement benefits available to employees generally, and a limited amount of other benefits and perquisites. This section describes the different components of our compensation program for named executive officers and describes the process for how compensation decisions are made. We provide market competitive base salaries to attract and retain outstanding talent and to provide a fixed component of pay for our named executive officers. Base salaries are reviewed annually and are determined with consideration to the role of the executive, time in position,the officer's experience, competitive market data regarding similar roles in similar organizations, internal equity, individual performance, budget, and other considerations. The Compensation Committee uses the median of market data as the general reference point for base salary decisions because it believes that the median is the best representation of competitive salaries in the market for similar roles and talent. In settingconsidering base salaries for 2016,2019, the Compensation Committee considered the officer’sofficer's experience in his or herand current role, the impact of his or her role on the Company’sCompany's results, the overall quality and manner in which the officer performs his or herthe role, the financial position of the Company and the value of retention.retention, among other factors.

ANNUAL INCENTIVE PLAN AWARDS

Incentive Compensation

With input from management and its independent executive compensation consultant, the Compensation Committee reviews and discusses annual corporate and business unit performance metrics and targets, and the appropriateness of these performance metrics and targets considering the following primary factors prior to approval: | ● | Expected performance based upon the annual operating plan as approved by the Board; |

| ● | The economic environment in which we expect to operate during the year, including risk factors; |

| ● | The achievement of financial results expected to enhance stockholder value; and |

| ● | The strategic goals and initiatives of the Company. |

The Compensation Committee also establishes a bonus pool aimed at potentially preserving the ability to deduct compensation paid under the annual incentiveoperating plan as approved by the Board;

The economic environment in which we expect to operate during the year, including risk factors; The achievement of financial results expected to enhance stockholder value; and The strategic goals and initiatives of the performance-based long-term incentive programs. The bonus pool approach establishes a maximum dollar amount and a maximum number of share units that can be paid to the Chief Executive Officer and certain other named executive officers from which the Compensation Committee may exercise negative discretion in determining the actual amounts paid under the annual and long-term incentive plans. The amounts the Compensation Committee approved for payment were below the maximum amounts established under the bonus pool. Please also see the section titled “Other Program Design Elements – Tax Deductibility of Executive Compensation” on pages 21 and 22 for additional information regarding the pool structure and approach.Annual Incentive Compensation

Target Opportunities